Introduction to Quicken and its Investment Tracking Features

If you're like most people, tracking your investments probably isn't at the top of your to-do list. But if you want to be a successful investor, it's important to keep tabs on your portfolio. That's where Quicken comes in.

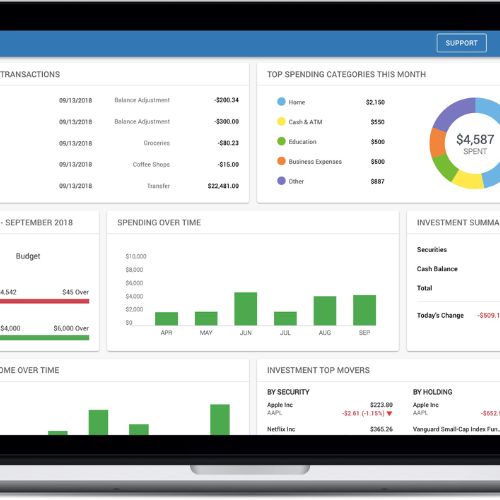

Quicken is a personal finance software that can help you track your investments and monitor your financial situation. In this article, we'll show you how to maximize Quicken's investment tracking features so that you can make informed decisions about your money.

Setting Up Your Investment Accounts

Assuming you're already familiar with Quicken and have it installed on your computer, the first step is to set up your investment accounts within the program. This can be done by going to the Accounts menu and selecting Add an Account. From there, you will need to select Investment from the list of account types and enter in the relevant information for your account, such as the name of the brokerage, your account number, and the type of account (e.g. IRA, 401k, etc.). Once you've entered all the required information, Quicken will automatically begin tracking your investment activity and updating your account balances accordingly.

Automating the Tracking Process

Once you have set up your investment accounts in Quicken, you can automate the tracking process by downloading transaction data from your broker. This will save you the trouble of manually entering each transaction. To do this, go to the Tools menu and select “One-step update.” Then, follow the instructions on the screen.

Conclusion

With the step-by-step guide provided, you should now have a good understanding of how to maximize Quicken's investment tracking features. Having an efficient way to track your investments is essential for any smart investor and Quicken provides a great platform to do just that. Keep in mind that with all investing comes risk, but with careful planning and constant vigilance you can make sure that your investments are performing as best they can. Now get out there and start making money!